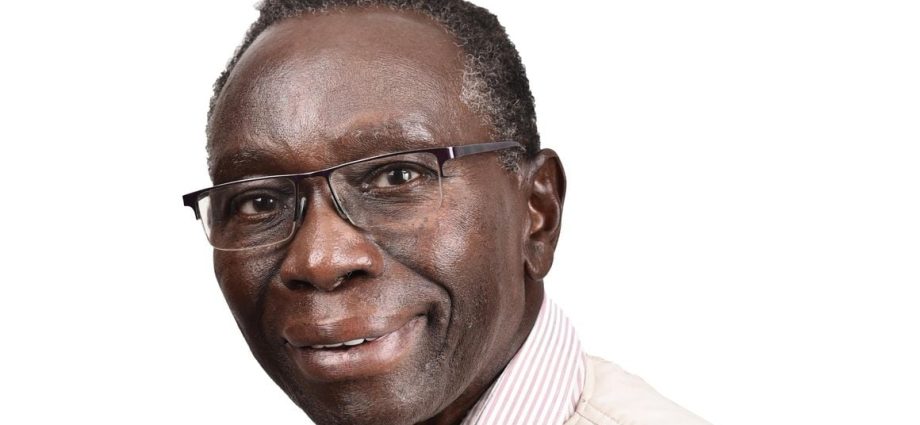

Billionaire investor John Kibunga Kimani has bought an additional 10.8 million shares of Centum Investment Company Plc currently worth Sh90.7 million, raising his stake in the firm that remains undervalued in the market. Business Daily reported on Tuesday quoting regulatory filings.

Regulatory filings show that Dr Kimani raised his holdings in the investment firm to 45.5 million shares in December 2023, up from 34.6 million in March 2023. This saw his stake rise from 5.21 percent to a new high of 6.84 percent, ranking him third after the estate of the late businessman Chris Kirubi (30.82 percent) and the State-owned Kenya Development Corporation (22.96 percent).

Dr Kimani, a long-term investor on the Nairobi Securities Exchange (NSE), has been buying shares of Centum and other firms, including Safaricom and agricultural firm Kakuzi. His latest purchase of Centum occurred amid the stock’s decline to record lows, plunging to Sh7.6 on May 22, 2023, before rising to the current Sh8.34.

Centum’s share price has dropped substantially from a peak of Sh84.5 recorded on September 23, 2014 when the market reacted positively to news that the company had won the contract to build a $2 billion (Sh327 billion at current exchange rates) coal-fired power plant in Lamu.

The proposed project did not proceed in the wake of opposition from environmental activists and financiers who developed cold feet.

The share price subsequently declined below the company’s tangible assets, with management switching from the previous debt-fuelled expansion to a more conservative strategy partly anchored by the substantial holding of liquid and cash-generating assets, including government bonds.

n the half year ended September 2023, Centum’s net asset value per share stood at Sh62.82. This indicates that the company’s share price is trading at an 86.7 percent discount.

Centum had bought back a cumulative six million units of its own shares as of November 20, 2023 as part of its efforts to close the gap between its share price and net assets.

Share buybacks have the effect of reducing the volume of outstanding stock, potentially boosting the share price besides raising the stakes of continuing shareholders.

The investment firm has been making losses in recent years but has nevertheless maintained dividend payouts using cash generated from the marketable securities portfolio.

Story credit: Business Daily